So this year again, my motor insurance policy was about to expire, and I got to check it online for renewal. And here are the findings. In summary, the last year trend continued - the cost of motor insurance renewal was still higher than that of a new insurance policy, that too with a low Insurance Value (IDV).

Online Motor Insurance Renewal: Cost Comparison

Then, I also compared the online quotes from other insurance companies and found that their IDV value higher and their premium is lower, which clearly indicates that blindly Renewing your Motor Insurance Policy Online may not be the best bet. Although it may differ from one insurance company to the other, but this is the case which I've observed with ICICI Lombard for 2 consecutive years.Here are the findings:

First something about the terms used:

IDV - Insurance Declared Value - This is the amount of money you will receive in case something happens (theft, fire, accidental damage) to your vehicle during the insurance period - subject to pro-rata basis.

Premium - this is the charge you pay for buying your motor insurance policy

In essence, one should look for Policies with less Premium and high IDV values.

Online Renewal of Old Motor Insurance Policy from ICICILombard website:

So when I generate the quote for renewing my insurance policy online, like last year (See those details here ICICI Lombard Motor Insurance: Online Renewal: High Cost, Low Value), I again saw a low IDV and a high premium (something not desirable). Going by last year's experience, I was not surprised. Here is the screenshot of what came up on the renewal for motor insurance - IDV of just 20707-00 and a insurance premium of 876-00.

What I was also surprised at that this amount of low IDV and high premium was despite they offering the so-called No Claim Bonus or NCB. This is the bonus you are eligible for in case you have not made any claims in your old policies. Since I have a no-claim record for last 4 years, I was eligible for a whooping 45% NCB . But even after that discounted bonus amount factored in, the IDV value was only 20707 and net insurance premium was high - 876.

What I was also surprised at that this amount of low IDV and high premium was despite they offering the so-called No Claim Bonus or NCB. This is the bonus you are eligible for in case you have not made any claims in your old policies. Since I have a no-claim record for last 4 years, I was eligible for a whooping 45% NCB . But even after that discounted bonus amount factored in, the IDV value was only 20707 and net insurance premium was high - 876.Online New Motor Insurance Policy from ICICI Lombard for same vehicle:

So, to make a compare of Renewal v/s New Policy purchase, I generated a new policy quote for the same vehicle from ICICILombard.com website. Like last year, it was showing HIGHER IDV 20757 and LOWER premium charge of only 721-00 compared to those for the renewal policy option, for the same old vehicle.

I was mentally prepared for this as this was what I observed last year as well. But again, the question is if a loyal customer is renewing his policy with the insurance company that too on his own through internet (with no effort from the insurance company agents), should he be charged a higher amount or should he be given some discount??

May be I am missing something here as I am not an insurance expert, but I do understand things from a customers' perspective.

If I go for online renewal from ICICILombard, I am being charged higher insurance premium and get a low value IDV.

If I go for new online policy, I am charged a compartively less insurance premium and get a slightly better IDV.

What do we call this - easy insurance renewal at the click of button, or fooling around with loyal customers?

Anyways, I decided to check on some other insurers. Here is what I got on other insurance websites:

Online Motor Insurance Quote from IFFCO-Tokio general Insurance company:

I generated the quote for the same vehicle from IFFCO-Tokio insurance website. And here is what I got:

For the same vehicle, IFFCO-Tokio provided an IDV value of 27,400-00 and the net premium was 806 Rs.

I then added the No Claim Bonus (NCB) of 45%, since there was no claims made by me in my previous ICICILombard Policy in last 4 years, and with the same IDV value of 27400-00, the net insurance premium came down to just 632 Rs.

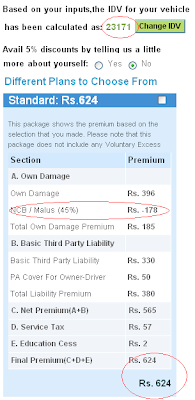

Online Motor Insurance Quote from Bajaj Allianz Insurance:

Here is what I got from Bajaj Allianz Insurance website for my vehicle insurance policy:

IDV value: 23171, Insurance Premium: only 624 Rs. with 45% No Claim Bonus (NCB).

If you have any questions/queries/concerns regarding this article, FT Times team will be happy to address them. Please post your questions in the comments section by clicking on the link "Post a Comment" at the end of this page

Conclusion about renewing your insurance policies online:

In essence, it all looks sweet and easy to use - Just login to the insurance website, click a few buttons, make payment and there you have your policy to print. But the fact is that being a customer, you need to look for better value (High IDV amount) with less money (low premium amount). To reiterate again, I'm not an insurance expert but I am surely an insurance policy customer. My experience with ICICILombard for their online renewal mechanism has not been positive one - as a customer, I want to pay less and get more. Online Renewal isn't allowing that to happen. It's a kind of surprise that from the same insurance company, the renewal charges are higher with less IDV as compared to buying a new policy. That is not what a loyal customer would like.

So finally I settled for one of the other insurance provider - one that was providing me higher IDV with low Insurance Premium. I dont know how will they treat me next year and quite possible that I might again get into the same situation with them as I have observed with ICICILombard in this and previous year. But that's something which will come up next year.

So One thing is certain - I will definitely check and shop around for a better deal - Always! And that too can be done online, no need to run around with you vehicle from one insurance company office to the the other. Hope the readers also do the same.

No comments:

Post a Comment