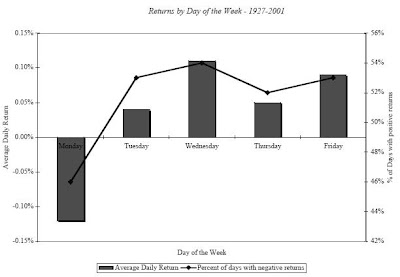

It attributes to the differences in returns between Mondays and other days of the week.

-- Over the years of observation of stock market data, returns on Mondays have been consistently lower than returns on other days of the week.

This is also termed as the “Monday effect on stock prices”

Reasons for The Weekend Effect:

The Monday effect is really called a weekend effect since the bulk of the negative returns is compensated in the Friday close to Monday open returns. The returns from intraday returns on Monday are not the actual reasons in giving away the negative returns.

The Monday effect is far more prominent small stocks than for larger stocks.

The Monday effect is eqully worse following three-day weekends than two-day weekends.

There are some other reasoning like arguments that the weekend effect is the result of bad news being revealed after the close of trading on Friday and during the weekend. Even if this were a commonly observed case, the return behavior would be inconsistent with a rational market,

| since rational investors would build in the expectation of the bad news over the weekend into the price before the weekend, leading to an elimination of the weekend effect. However, this effect can still be observed. In the next article, let us discuss about the weekend effect in international markets | Table of Contents |

No comments:

Post a Comment