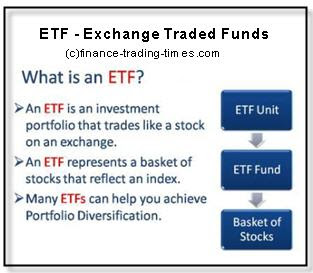

Today, we've been joined by a new member in the contributors group. He likes to called Monty and will be working on doing a "transperancy analysis" on companies, businesses, countries and more, in his own unique critical, hilarious style. Enjoy these articles from Monty Hello Everyone. I thought of starting my venture on FT Times with something on the bigger businesses. The king of Internet - Google!

Why I selected Google? Well, I really like it's search engine. No, I'm not talking about quality, but about the way it initially designed itself in the beginning (and in turn forced other search engines to become algorithm based rather than directory based).

It was Google Search Engine which enabled each individual on this planet to find info on the internet, if not in the first few results, atleast some relevant info somewhere down the line. Quality I will discuss later.

Google Logo from Google.com

Google Logo from Google.com Another reason for taking on Google as a topic was the recent developments. The Google Chairman, Eric Schmidt, recently stepped down, declared to sell his Google Shares.

One thing I really like about the corporate world is any news - good or bad - is conveyed in such a good diplomatic way that it appears to be a really positive news. So there we had it - on the Official Google Blog - Eric posted his message about how positive development this is going to be (

See Google Blog Post by Eric. It appears that Google does not need any "adult supervision" anymore.

However, the world around the corporates - the media, the analysts and all - have their own ways of interpreting the information. So

The Guardian quoted the news as saying Eric is actually being replaced by Larry Page. Moreover, Eric is going to sell a good enough portion of Google shares.

Eric was instrumental in many things - he was there with Google for more than a decade, was instrumetal in making Google a public listed company, and all of a sudden, his "adult supervision" was no longer needed.

The market was shocked at such development.

Now let's see what led to this situation (offcourse in my style and from my perspective):

- In essence, Eric has made way for Larry, the founder of Google.

- "No Adult supervision needed" is something which might indicate the need for new innovation, new ideas and their successful implementations

- May be that is something Eric failed to drive, so the company goes back to the basic roots - innovation in areas where it failed

- Company did grow with Eric, but the growth appeared only in no. of employees but no new innovative and materialistic money generating products coming in

- More problems than businesses - Google locked horns with governments and other regulatory authorities - for eg. had to leave China

Where did it suffer setbacks?

Almost everywhere. Let's have a look it in a dialogues form (Again, my perspective, just in a good format :-)

Q: Hey Google, what happened to the venture into the mobile phone business? (We questioned it earlier also

Google Nexus One Phone: Does Google really need it?)

Google: Yeah. We did that well (we suppose). So what if we fail to make a mark. So what if there were already cheap (and better) smartphones available from Chinese market at lower prices. We did try our innovations!

We kept our employees happy by distributing the nexus to them.

Q: How about the social media failures?

Google: Failures - what failures? Dont you know we created a lot of "Buzz", then we already had "Orkut" (heard that name before), then we surfed on the "Wave". We're still experimenting.

Q: OK, Gmail is still the best?

Google: We believe. The so called gmail killer by Facebook still does not exist. Gmail is loved by all

Q: How about the Apps market?

Google: Well, there are some news that Apps market is not picking up. But that's fine.

Q: Chrome did do really well - fast browser built up the market share in no time

Google: Yes, that's what we are banking upon. We even invited selected US based users to participate in the lucky draw and get a Chrome based netbook free for trial. Looking forward to it.

Q: Now to the core - what about your search stats and quality?

Google: Quality - who questions our quality, we decide the quality.

Remember the buzz - "Google takes more than 200 parameters into account for search engine rankings". What they are, nobody will ever know (probably even google doesn't)

We keep experimenting - it now appears that anything on any news websites will be given precedence. So whether you search for an "XYZ Review", all one will get to see is news websites which dont really contain a review, but generic news information about XYZ. So search for a "review" will lead you to "news".

Although there are some really good authentic sites included in "Google News", we also accomodate some copy-cats. (There should be room for all). After all, we take the call. No problems if users get unhappy with the results in a small no. of cases.

Q: What about Spam Handling?

Google: Spam is what we are fighting with at the moment. So what if we have to block lots of sites and blogs. It does not matter who published what at what point of time. If our algorithms believe that it is spam, so it is. We've pulled the plugs - let the "spammers" suffer.

A small guy publishes a good original content on his small blog. After sometimes, Big guys copy it on their Big site (including Google News verified sites).

In our ways, Big guy is big, so it must be the small guy who has copied from the big guy. So punish the small guy and call him a "spammer". We have fool-proof algorithms to do that. Unfortunately, despite our algorithms take 200+ parameters into consideration, our algorithms aren't smart enough to take publish time into consideration - whether the small guy published it first or the big guy copied it later.

Even though our increasing headcounts are being questioned by Wall street analysts, we still rely on our algorithms to decide what is spam. We dont have enough people to decide the spam - that task is outsourced to our algorithms - they take the call. Spammers are out!

The internet is our kingdom, we'll clean it up the way we want it. End of the Story!

Q: What are the future plans?

Google: Looking forward to some more innovations under the new leadership.

We're doing a lot of experiements -

Solar Panels Energy: Angle of Solar Panel Tilt Correlation: Google Experiments After all, there are more things to do than search.

End of Q&A.

Now, Google appears to be in a transition phase. From a company working from a garage, to the internet search engine king, to the public listed company, to the business expansion in non-core markets and now back with the founders in the driving seat.

The "Do No Evil" company needs more insights for capturing the market share. Already, lost grounds in China and similar other countries with huge population. Remember, Google clients are commmon people (apart from a handful of corporates).

The "Spam" elimination exercise has already made a lot of people furious. Publishers, Bloggers have turned their back to Google.

Search being its core, is taking a hit. Everything in top search results comes from NEWS websites. Seems like the algorithm needs a rethink.

Support - does it really provide any? Everything is left to volunteers who "try" to help on open forums. No questions can be asked, no answers can be demanded, no liability. This is where it needs to work on.

With other search engine giants like Bing and Yahoo coming out in a big way, dont be surprised if Google starts loosing its search market share also. It needs improvement, and quickly. Twitter and Facebook are way ahead - Technology runs at a rapid pace

Google Logo from Google.com

Google Logo from Google.com