Related: SBI GETS-SBI Gold ETF NFO Review: SBI Gold Exchange Traded Scheme & Gold ETF: Historical Performace of Gold ETF & Gold ETF India

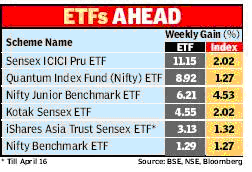

Then recently, Times Of India came out with an interesting observation. They provided a comparative analysis of the various Index based ETF in India. Though I have been proposing that the index based ETF's always track the underlying index almost exactly, but the report published by TOI seems to differ. Here is the digital image of the table about comparaive analysis of Index based ETF Exchange Traded Funds in India (as published by TOI - Image Courtesy TOI).

It compares six ETF's which are based on Sensex or Nifty. They are:

1. Sensex Prudential Icici Exchange Traded Fund ETF

2. Kotak Sensex ETF

3. Quantum Index Fund (Nifty) ETF

4. Nifty Benchmark ETF

5. Nifty Junior Benchmark ETF

6. iShares Asia Trust Sensex ETF (listed in Hong Kong)

As per the table above, the ETF have outperformed the underlying index by a significant margin (remember, 2% and above is considered to be significant). So how can that happen when it comes to the fact that ETF's closely mirror the underlying index? The answer lies in the trading activities. Suddenly there is a positive sign in the market so the investors want to invest their money in it. However, they have seen the fate of index listed companies like Satyam, which are busted for fraud, hence they do no want to take the company specific risks. So what is the best way to go forward, it is to invest in these Index based ETF and garner the returns without the company specific risks.

Related: Large Cap ETF v/s Mid Cap ETF: Historical Performance Check

Then how about the variation in the returns of the different ETF which are based on the same index?

Probably, that's where the company fund management comes into picture. If more investors of ETF have the faith in say, ICICI fund management company, then obviously the demand for ETF from ICICI will be higher compared to others.

So what's the net conclusion for us? Again, its all random for the short term, but if you are going for the long term, most of the ETF will give you the similar returns with 1-2% here or there

No comments:

Post a Comment