And this is what a London based investment firm is planning to do. It is attempting to come out with an investment product, expected to be a Hedge Fund, which will be based on Twitter.

Twitter-Based Hedge Fund

Does that sound interesting - or unimaginable? But that is what is expected to happen if this hedge fund comes to reality. Millions of Sterling Pounds will be betted in the stock market through this Twitter based hedge fund, if this becomes a reality.How will the Twitter-Based Hedge Fund work?

Twitter-Based Hedge Fund Working Explained: Any model, any algorithm, any trading strategy in the stock markets is based upon certain assumptions. The same is true with the Twitter-Based Hedge Fund working assumptions as well.

It is claimed that some recent research has shown about the mood of twitter tweets and apps usage can be used as a guide to predict the stock markets up or down movements.

The stock markets and the updates on the social networks, both work on one thing called the Human Sentiments. The messages that people post on their social network status can be a key to their mood.

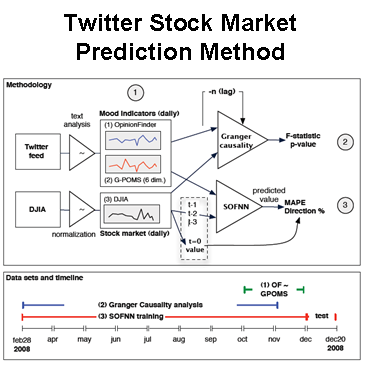

Here is a picture/flowcart explaining how the Twitter-Based Hedge Fund will work to extract the stock market mood from the tweets.

If someway, one can effectively track the stock market participant moods from their social network status, then there is a chance of good success in predicting the stock market trends and this is what will be the basis of Twitter-Based Hedge Fund and its working.

What are the risks and challenges in the Twitter-Based Hedge Fund ?

Nothing in this world is risk free.

The first and foremost thing is that this hedge fund is based on placing trades on human moods as predicted from their social networks.

That itself poses a big challenge. Observe so many dependencies which are here.

First, extracting a list of legitimate people who will be active in stock markets and following them. There have been many fake profiles around

Second, what is the guarantee that these legitimate people will post their real mood.

Third, even if they do post their real mood, will they post it regularly?

Fourth, Is it really possible to extract the information on stock market trends based upon the calm or anxious language used in the status posted on social networking sites like twitter.

As you can see, there are many dependencies.

Which investment firm is launching the Twitter-Based Hedge Fund ?

Derwent Capital Markets from London will be launching this Hedge fund.

Since it is a hedge fund, it will be common investors money which will be betted on.

What is the success rate claimed for the Twitter-Based Hedge Fund ?

The research report which studied the correlation of twitter moods and stock market movements claims a accurate or success rate of huge 87.6% on a saily basis for index like DowJones. Each model, when introduced, claims a high success rate. However, things fall apart when the real trading and investment business happens.

How much of this will be actually true in real world of hedge fund trading, can be checked only after this hedge fund begins its operation.

Investors need to take a call on investing in this Twitter-Based Hedge Fund

No comments:

Post a Comment