It's time now to look at what is going on in the ETF markets in USA and which ETF's are becoming bigger and better. Does the price of fund i.e. fund management charges have any impact on the selling of funds?

If you look at the latest list of ETF's as per the value of investments, then the answer to that question comes out to be a Yes - i.e. price of funds do matter to investors.

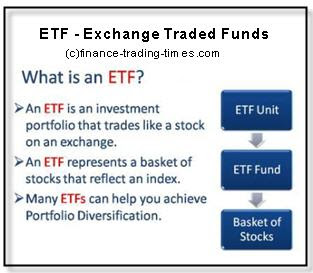

First of all, let's have a look at the list of Largest ETF's as per the recent data prepared by Bloomberg. For more details about benefits of investing in ETF or Exchange traded funds, please see ETF Investing: Investments in Exchange Traded Funds.

Figures in the bracket is the amount for assets under management for each of the funds.

.

1 - SPDR S&P 500 ETF Trust by State Street ($90 billion)

2-

3- Vanguard Emerging Market ETF ($46.2 billion) - (See all Popular Vanguard Mutual Funds)

4- BlackRock iShares MSCI Emerging Markets ETF ($46 billion)

It is known that the US ETF market is close to 1 trillion USD. Out of that, the leader SPDR S&P 500 ETF Trust manages almost 10% of the total US ETF market. The rest around (4.5% each) is now with no. 3 and no. 4 rank holders.

We will concentrate our discussion on the two funds only (listed no. 3 and 4 above) because they both track the same index.

What is more important to note in the above list is that although Vanguard is just marginally above BlackRock (only difference of 0.2 billion), the situation was completely different a year ago. It was the BlackRock fund which was almo0st double the size of Vanguard Emerging Market ETF.

Hence, this clearly indicates that Vanguard has been able to pull lot of ETF investors to its funds in the growing ETF market, while BlackRock fund appears to be loosing its base.

Why has this happened? Why BlackRock iShares MSCI Emerging Markets ETF lost to Vanguard Emerging Market ETF?

The answer perheps lies in the cost or price for funds. Whenever any investor invests his money to buy any ETF units, the fund company charges an amount. For Vanguard, the amount is only 27 cents per 100 USD, while for BlackRock, it is 69 cents per 100 USD invested. A big difference of more than double the charges.

Now since both these ETF funds are tracking the same underlying index, where should an investor go if there is a big difference of more that double in terms of the fund charges? The answer is simple - people like to buy cheap and that is what Vanguard has been able to do successfully.

No wonder it has established itself as the no. 1 low cost mutual fund house using the same low prices formula.

So what's the word here? Prices do matter! - whether it is a supermarket or consumer durables or investments, prices do matter and when people are given a choice between 2 similar things, they will obviously go for the cheaper one.

Another thing that might have hit the BlackRock iShares MSCI Emerging Markets ETF loosing its market share to Vanguard Emerging Market ETF is the returns from both these funds. Both these ETF Funds track the same underlying index. However, BlackRock iShares MSCI Emerging Markets ETF has returned only 137 percent compared to Vanguard's 151 % (Data as per Bloomberg). That again gets to fund management and its performance. At the end of the day - its the returns that matter, and as per the above data compiled by Bloomberg, Vanguard fund managers have been good enough compared to BlackRock.

Performance, as well as Prices, both matter for the investment business

No comments:

Post a Comment