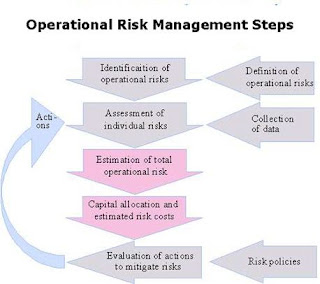

Let's continue further with the basics for the Operational Risk Management & Best Practices:

Step 1:Define and Identify the Operational Risks :

Step 2:Develope Measures of Operational Health :

- The role of compliance and risk managers - What Should We Be Watching?

- Define the process and stesp - Set up Standards for Good Operational Performance

- A stitch in time saves nine - Developing a Strategy of Early Response to Problems

Step 3:The Importance of Independent Reporting Function to Assure Metrics Integrity :

Step 4:Risk Management: Should it come at the cost of cost cutting?: Controlling Risk in a World Focused on Controlling Costs - What To Do

Step 5:Automation and Straight through processing : The Role of STP in Enhancing Intraday Operational Risk Management

Step 6:The regulations and standards to be followed: : How Will Basel Capital Requirements Impact the Management of Operational Risk?

Step 7:Even the regulatory requirements are not fool proof: The Operational Risks Inherent in the Explosion of Regulatory Requirements

- Patriot's Act, Sarbanes Oxley Act and Beyond

Step 8:Settlement Risks and Risk Management:

- What Are We Living With Now?

- When can we really Get to Virtual T+1?

- Why Bother about this kind of Risk?

Step 9:Learning From Old Problems and the Mistakes of Others :

- Managing Operational Risk With an Eye to History and Today's Newspapers

- The Need for Truthful and Full, Honest Communications Within and Among Financial Institutions

No comments:

Post a Comment