Let's begin with the basics for the Operational Risk Management & Best Practices:

Introduction to Operational Risk Management in trading and investment scenario:

- Using Derivatives Versus Trading the Underlying Asset/Security/Commodity

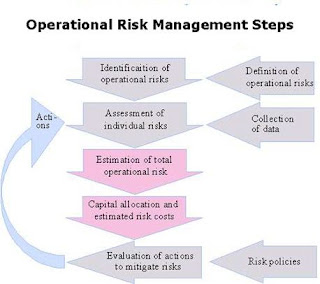

Drivers And Design of Operational Risk Management Steps:

- Recognize the requirements for operational risk in your company/organization

- Build upon an operational risk framework & Optimize its design

- The key elements of an operational risk management framework

- Planning the implementation or enhancement of an operational risk framework

- Track the progress as it is recursive in nature

Training, Marketing And Culture Change for Operational Risk Management:

- Need for an effective Operational Risk Management training program

- Whether to launch a Operational Risk Management plan

- Effects and requirements for culture change

- Making and Winning over partners: Audit, SOX, Compliance etc.

Risk And Control in Operational Risk Management :

- Advantages and Disadvantages of different styles of RCS

- Plans for RCS implementation and its maintenance

- Setting standards and procedures for RCS

- Setting scope and content of RCS

Key Risk Indicators (KRIs) within Operational Risk Management:

- Types of KRIs

- How to collect the KRIs which are relevant to your organization's Operational Risk Management

- Identify the root cause or Sources of KRIs

Importance of Reporting in Operational Risk Management:

- The need of Answering the "So What?" questions

- Effective loss data reporting

- Effective RCSA reporting

- Effective KRI reporting

- Effective operational risk reporting

Selecting the right IT or Technology Tools :

- Build or Buy Decision

- The RFP process

- What to ask in a demo

- Assessing how a technology tool might fit your needs

No comments:

Post a Comment