In this article, we will analyse how good is this Reliance Small Cap Fund NFO, whether this Reliance Small Cap Fund offers anything new or unique for the investors and whether the investors should invest in Reliance Small Cap Fund .

Reliance Small Cap Fund NFO: Review Analysis & Details

Let's begin with some basic details about Reliance Small Cap Fund.What are the NFO dates for Reliance Small Cap Fund ?

The NFO period for Reliance Small Cap Fund will open on 26th August and will close on 9th September 2010.

What is so unique about this Reliance Small Cap Fund?

The Reliance Small Cap Fund claims to be for the "High Risk-High Return" methodology. The reason for this is that it will invest in so called small cap companies, which are expected to become the shining stars tomorrow and that's where the name of the fund is derived from. However, not every small cap company can be successful. So there is no guarantee that the small cap stocks which the fund managers at Reliance Mutual Fund select for investment, will become the high return giving stocks. So the investors need to keep the risk in mind.

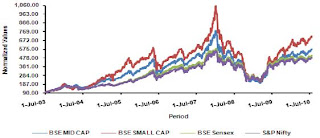

Our thought on this is that it all depends upon the timing. As cited with an example in this article: Relative performace of mid-cap stocks v/s large-cap stocks, the relative performance of small cap, mid cap, large cap all varies as per time. It is this timing that the fund managers try to capitalise upon. Whether they are successful or not and what net return does an investor get, is a different question altogether. The offer document claims that the high volatility in small cap stocks is smoothened over a long period of time, so this Reliance small cap fund is for the long term investment. But there is no guarantee of anything. Overall, the investor should keep the High Risk in mind, if they are investing in any small cap stock specific fund aiming for high Returns.

There is also a performance graph in the offer document which tells about the relative performance of the various sectors over a long period of time. However, one must note in the graph that it all depends upon the time of investment and exit. It's easy to look at the historical data and come to a conclusion. Difficult part is to predict the future and act accordingly. Ultimately, it all depends upon how you fund managers trading activity works to your benefit. Continue to Part II- Is this fund worth investing?

No comments:

Post a Comment