This is part II of the article Reliance Small Cap Fund: Review Analysis & Details - I. Please read part I before proceeding with this one.

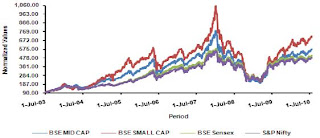

There is also a performance graph in the offer document which tells about the relative performance of the various sectors over a long period of time.

However, one must note in the graph that it all depends upon the time of investment and exit. It's easy to look at the historical data and come to a conclusion. Difficult part is to predict the future and act accordingly. Ultimately, it all depends upon how you fund managers trading activity works to your benefit.

So overall, this Reliance Small Cap Fund seems to be a focussed fund on small cap sector.

Sunil Singhania will be the fund manager.

The money will be invested in the following proportions:

The money will be invested in the following proportions:65% to 100% - Small Cap Stocks

Rest 0-35% in domestic debt and money market instruments or even in other sector equities

During NFO, the units of this Fund will cost Rs 10 per unit.

Are there any alternatives to Reliance Small Cap Fund?

You can look for a small cap based ETF or Exchange Traded Fund which is benchmarked to any small cap index.

Then IDFC also recently filed for a similar Mutual Fund called IDFC Small Cap Equity Fund NFO: Review

The Reliance Small Cap Fund will be benchmarked to BSE Small Cap Index

Minimum Investment:

Purchases : Rs. 5,000/- and in multiple of Re. 1 thereafter.

SIP or Systematic Investment Plan is available? - No Info

No Tax Benefit is available in the Reliance Small Cap Fund

Investment Options for Reliance Small Cap Fund :

- Growth Plan: Growth & Bonus Option

- Dividend (Payout and Reinvestment)

The entry load for Reliance Small Cap Fund is as follows:

Entry Load for Reliance Small Cap Fund :

Zero Entry Load

Exit Load for Reliance Small Cap Fund:

This is High - 2% if the amount sought to be redeemed or switched out is invested up to 1 year from date of allocation.

1% if redemmed within 1 year to 2 years, and Nil after 2 years.

Final Thoughts about the Reliance Small Cap Fund?

This fund can be a good investment for investors willing to bet on the skills of the Fund Managers and who believe that the small cap stock investment story based upon the stock selection skills of fund managers. Although as of now, there are no "dedicated" Small cap funds available in the Indian Mutual Fund markets, so this Reliance Small Cap Fund might look good for investors who are quite keen on investing specifically in "Small Cap Sector". But the important point to note is the asset allocation - although this fund calls itself "Small Cap Fund", only 65% of capital will be invested in so called small cap stocks.

So there are some more funds available with that kind of capital allocation. At the same time, it will also be worth looking at small cap based ETF or Exchange Traded Funds which offer the benefit of intra-day price movements and trading.

No comments:

Post a Comment