Advantages of Commodity Trading:

Firstly, many investors have burnt their fingers in the recent turmoil in the stock markets across the globe. Hence, such people are now looking for alternative investments and Commodity Trading is one such option available to them.

Secondly, a Commodity is a real asset. Its not a virtual asset like stock or bond. A Commodity is produced, while a stock exists virtually. So people can make better interpretations of the Commodity Trading trends, by looking at weather reports, geographical circumstances, etc. Compare that to a company stock valuation, everything is hidden. Nobody knows what is going on within the company and whether the financial results disclosed are correct or not. Hence, there is better understanding on Commodity Trading.

Thirdly, Commodity Trading helps in hedging against unexpected price movements for the actual producer or the Commodity, like a farmer. He can lock in the profits much before the produce is available and can be shielded away from the various pricce movements in future.

What has been the historical performance of Commodity Trading and Commodity Mutual Funds?

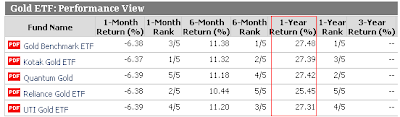

We have done a study of best performing mutual funds in the article Best Performing Commodities Mutual Funds. It has been observed that Top 3 best performing stocks mutual fund over the past 1 year were actually the commodities funds.

What are the pre-requisites for Commodity Trading?

You must select what you want to trade on. Commodity trading is available for anything and everthing - Crude Oil, Gold, Silver, Potato, Soya, Pork, Beans, Oranges and almost every single thing that can be classified as a Commodity.

So if you believe that Gold prices are going to fall, you can short sell a Gold Commodity Future. If you believe that Crude Price is going to go up, then you can buy a Crude Oil Future. If you are an expert in crop production analysis or weather analysis, and you believe that Soya Crop is going to take a hit this year, then you can short sell Soya Futures. Or if you feel that a deadly flu can cause the pork industry to take a setback because it will affect lots of pigs, then you may short sell Pork futures.

How can you do Commodity Trading?

Today, the world is running over internet and mobile devices. For Commodity Trading, the simplest way is to open an Online Commodity Trading account with a Commodity Broker and all the orders can be placed at the click of a button. Do remember to check the quality of service and feedback about the broker.

Why should someone trade in Commodity

Commodity Trading allows you to benefit from price changes, without actually having to buy that Commodity. For e.g. if you believe gold prices are going to go up, then you can buy gold bars. However, you will need sufficient money to buy Gold Bars. Then you will have to worry about the safe storage of the gold bars which may further cost you. Third, you will have to rely upon your goldsmith to trust the quality of gold.

Compare that to Commodity Trading. You dont need full amount of money to buy the Gold, as you can trade on margin (a percentage of actual price). Then, you dont have to worry about storage as the Gold future contract is stored in your demat account. And third, you dont have to worry about the quality of gold, as that is implicitly covered in the Gold commodity futures contract.

What are the risks in Commodity Trading?

MTM Losses: The biggest risk in Commodity Trading is the MTM losses or the Mark to market Losses. Suppose that you buy a crude oil future which is going to expire after 3 months time and your agreed price is $50. However, say after 15 days of you buying the crude future, the price starts to drop and reaches the level of $35. You will then have to pay the difference and it has to be done on a daily basis, which is called mark to market.

If the price drops significantly, then you will end up paying money on a daily basis for MTM losses, so one should be careful about that.

Related: Crude Oil Price: Can you bet on Crude Oil Futures NOW? & Best Performing Commodities Mutual Funds

What are the other ways of Trading in Commodities?

Instead of being an active trader, you can also passively trade in commodities. There are hundreds of Commodity based mutual funds which allow you to take a bet on commodities without being an active trader. Few of them are listed in the article link provided above.