Small cap investment is one of most common investment strategy for investors who have the potential to take the risk and afford the losses, if any.

Small cap investment strategy usually falls into the Passive Growth Strategy segment, which means that the investor believes in going for growth strategy for long term and has sufficient risk appetite to absorb the losses which are associated with the small cap companies and small cap stocks.

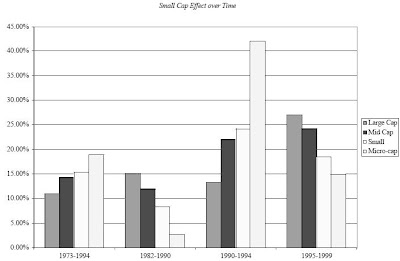

Here is some historical data which presents the returns available from the small cap stock investments over the period of 1973 to 1995.

As we can see from the above graph, the Micro cap and small cap stock performance over the 22 year long horizon has been varying. There is no sure shot way to identify which stock will perform in which way and within how much long duration. In one word, we again come back to “RANDOMNESS”.

Taking a bet on small cap stocks or micro cap stocks is risky in two ways. One, you are betting on the performance of the company which is already small. It is possible that instead of the company turning out to be a big cap stock, it may ultimately turn out to be a micro cap and may even go bankrupt. Second, you are betting on a long time horizon. Remember, the longer the time horizon, the more the risk.

Compare this to a large cap stock. I’ve tried to give a different perspective to looking at Good Stocks v/s Bad stocks. A large cap stock has somewhat better history and historical track record both of the company management and the results it delivers. Even then, if things start going wrong, the big cap may transform first into a mid cap stock, then to a small cap, then to a micro cap and finally may go bankrupt. The Stock Exchanges also place a circuit limit and band filter on each stock to decide the daily trading range. Hence, you have ample amount of time to cut your losses short and save a significant portion of your capital.

| Ultimately, you as an investor has to take the bet whether you’re going for small cap stocks or large cap stocks. Randomness rules in all cases! | Table of Contents |

1 comment:

Shobhit, is there any small cap fund(preferably ETF) available in indian market?

Post a Comment