One thing that we wish to highlight here is that there appear to be no problems with the ICICI Bank as of now. The long queues in front of ICICI bank ATM and branches have ensured that the money is withdrawn in large amounts so ICICI ATM s are getting empty. However, all the online facilites like ICICI Bank Fund Transfer Facility, ICICI Bank Internet banking, etc are working absolutely fine. That means there appears to be no problem with ICICI Bank and the Rumors of ICICI Bank Bankruptcy appear to be more of panic situation.

From the various resources available on the internet, here are some of the findings:

ICICI Bank Limited clarifies that 98% of ICICI Bank UK PLC’s non-India investment book is rated investment grade and above

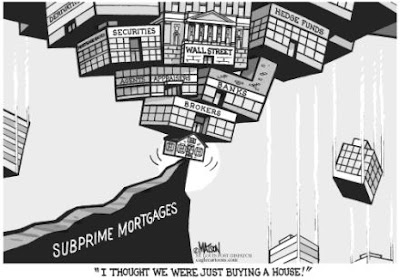

• ICICI Bank UK PLC has zero exposure to US sub-prime credit, whether directly or through credit derivatives such as CDO/CLN/CDS.

• About 98% of ICICI Bank UK PLC’s non-India investment book of USD 3.5 billion is rated investment grade and above (by S&P/ Moody’s/ Fitch). About 89% is rated A- and above (by S&P/Moody’s/Fitch).

Related: ICICI Bank Bankrupt Rumors & Effect on ICICI Bank for Lehman Brothers Bankruptcy

• Only about 18% of ICICI Bank UK PLC’s non-India investment book is exposure to the United States.

• In addition, ICICI Bank UK PLC holds cash equivalent instruments (inter-bank placements and certificates of deposit) of USD 1.1 billion. There is no exposure to US banks in this category.

• ICICIBank UK PLC has a total balance sheet size of USD 8.5 billion and has zero NPLs on the balance portfolio of USD 3.9 billion.

• As on the lastbalance sheetdate ofJune 30, 2008, ICICIBank UK PLC had a capital adequacy ratio of 17.4%

As per Economic Times, To ally any concern among the bank’s customers, the bank reiterates that:

• ICICI Bank has a very strong capital position, having proactively raised Rs 20,000 crore (about $5 billion) in June 2007, almost doubling its capital base. It has a net worth of over Rs 47,000 crore (i.e. over $10 billion) and a capital adequacy ratio of 13.4% at June 30, 2008, as against the regulatory requirement of 9.0%. This is among the highest levels of capital adequacy in large Indian banks. This reflects the healthy capital position and comfortable level of leverage. Its banking and non-banking subsidiaries are also well-capitalised.

• ICICI Bank has consolidated total assets of over Rs. 484,000 crore (over $105 billion), which is diversified across a wide range of asset classes in India and overseas.

• ICICI Bank is profitable. It made a profit after tax of Rs. 4,158 crore (over $900 million) in FY2008 and Rs. 728 crore (over $155 million) in the first quarter of this year. This was due to the strong core performance, which more than offset the impact of adverse debt and equity market conditions in India and globally since the second half of FY2008.

• ICICI Bank’s wholly-owned subsidiary, ICICI Bank UK PLC has, as part of its normal treasury operations, a diversified investment portfolio. ICICI Bank UK PLC has zero exposure to US sub-prime credit, and zero non-performing loans. About 98% of its non-India investment book of $3.5 billion is rated investment grade and above, with about 89% rated A- and above. In addition, ICICI Bank UK PLC holds cash equivalent instruments (inter-bank placements and certificates of deposit) of $1.1 billion. As on the last balance sheet date of June 30, 2008, ICICI Bank UK PLC had a capital adequacy ratio of 17.4%.

• The absorption of the impact of current market conditions on investment portfolio valuation will not pose any challenge to ICICI Bank’s capital position.

No comments:

Post a Comment