ICICI Bank Share price have gone down by a whopping14 percent in today's trading.

This has led to serious "mail-rumors" running around across the various IT industry workers. Few weeks back, when Lehman declared Bankruptcy, people queued up at ICICI Bank ATM and Bank Branches to withdraw their money. Now again, the IT employees are getting worried on these rumors. The biggest cause of concern is that most of the employees are having their Salary account with ICICI Bank. That will mean that majority of the liquid earnings of the employees will be kept with this bank.

Along with the ICICI officials, everyone hopes that this circus of rumors should come to an end. Savings bank account holders may not worry, as government will guarantee the return of their money in the savings account. In the past, around 4 years back, the GTB or Global Trust Bank had gone burst. It was later taken over by the OBC bank, a government run bank and all the savings account money was safe.

Hopefully, one should not see anything like this in the Indian Markets again. The banks are much better regulated.

29 comments:

I saw lot of people saying that All the ICIC Bank ATM are not working and the card is not working with other Bank ATM as well

I saw most of the Andhra people are withdrawing money from there account. i guess Roumors strated from AP.

What ever it is money is playing in this world

Hi,

I am pravin working in a IT company. Today just few hours a go i saw a big Quee in my office ATM machine. while thinking about this i heard that ICIC Bank has Bankrupt not sure if this is true.

what ever it is Govt or ICIC management has to put some information in there Bank Web Site.

Regards

Pravin -Chennai

Hi Friends,

Actually speaking all the Account holders of ICICI are having Faith on ICICI but the main issue came in when ICICI cards were not been accepted by other banks ATMS, and one more main thing is its Money bose hard earned Money no one will risk...........as i read in the Topic author was blaming IT people .......not only IT guyz any one will not risk even a pai......

Yes, All rumors now became true. ICICI is officially announced as they are going to stop all transactions by tomorrow and will be working with RBI to distribute the money and get the money to/from the customers.

They have given this in small letters in their official site.

Hello Again,

Please dont belive any fals news.

As mr.Anonymous saying there is no information given in ICICI bank site. only problem people beliving it and talking all the money from ICICI Bank ATM. soo others saying that there is no money in ATM.

Pravin was the first person in the Qu

ICICI will try to save their skin.. no one will put a message in their website that I'm in lose.. This is very good lesson to ICICI people (Blood suckers..)

Since last 6months waiting for this kind of news about ICICI.. I'm very happy to see this new about it.. and same time I pray for the account holders so that they get back their Blood.. from decoits...

The rumours started a week back when ICICI declared that they ahd a loss of $28 B because of patch up with Lehmann Brothers.

We should support ICICI and should have faith in them.

Because of tons of people withdrawing money from ICICI and other ATM centers, there is a money scarcity.

I think, there is no such situation rite now and its safe to keep money with ICICI bank

Hi Just now my friend draw the money from Chennai ICICI ATM.

This is all trash and crazy !@#$ guys. Never believe in these. I don't know why you guys make people Panic. Are these guys ready to give double of the money If I withdraw for them. Justnow My father withdrew an amount of Rs.5000 from a SBI ATM in a small town in AP. I'm ready for the other way to give the double of the money if I couldn't do. Please be prepared for this before you make any statment against SBI.

Facts abt ICICI Bank :

Check controversy in this site:

http://en.wikipedia.org/wiki/ICICI_Bank

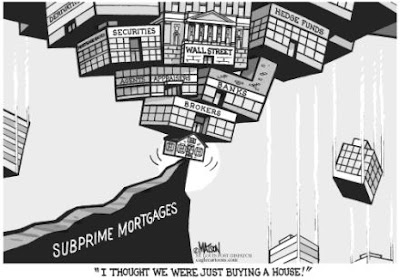

It could be true that the bank may have face huge losses due to their involvement with the US sub prime mortgage crisis. But that wont fail the bank, the only thing that will is the panic amount the public. Withdrawing money all of a sudden will eventually result in the collapse of the bank

Pls don't believe these rumors . I recently had a transaction .

I think the person who had put the comment "icici will stop all transactions by tomorrow and will be working with RBI to distribute the money and get the money to/from the customers " is playing with sentiments of ppl .

Hello,

ICICI is the bigest private bank in india and it will not face any problem .guys dont spread false statement which will hurt as well as waste time for others.

but all of above why ICICI bank is not coming forward with CLARIFICATION.......

They should come to media and clarify that every thing is ok.......

And We should expect one clarification from RBI as well.....

clarification at this point is not needed because ICICI don't care for a few fools withdrawing a few thousand rupees.

They will have problem only if big investors who do transactions in crores change their mind. And such investors are not fools like us.

ICICI is the second largest Bank in India and their loss of 100 odd cr in lehman brothers is nothing compared to their last year profit of 4200+ crs.. Our Banks are much regulated and Lets check with credible sources before acting on it..

And now all those rumours has been proved wrong, anybody can go to the branch or ATM and withdraw whatever money they want, they ll be just losing their interest income.. They have even opened their branches inspite of the half yearly closing where every other bank in the country has closed.. Now lets all go out and say all the banks in the country except ICICI has gone bankrupt because they are closed today!!!!!!!!!!

I absolutely agree with Ganapathy views We should check with credible sources before creating such panic

I absolutely agree with Ganapathy views We should check with credible sources before creating such panic

September 30, 2008

Dear Sir/Madam

We greatly value your relationship with us. In the context of the developments in the international financial markets, we thought it pertinent to bring to you our perspective of the prevailing situation.

We would like to bring to your attention that the Indian banking system is well regulated and significantly insulated from global developments. This is because it is mandatory for all Indian Scheduled Commercial Banks to retain 34% of the deposit base in the form of Government Securities (SLR) and cash with RBI (CRR). Besides, sound policies of RBI have ensured prudent credit practices in the Indian Banking system.

ICICI Bank is already compliant with the BASLE II requirement in respect of risk management practices and capital adequacy. At 13.4%, ICICI Bank has one of the highest capital adequacy ratios in the Indian banking industry. Last year, ICICI Bank raised Rs. 20,000 crores (US $ 5 billion) of equity capital, which almost doubled our equity capital base. We have a net worth of over Rs. 47,000 crores (US$ 10 billion), again one of the highest in the banking industry in India We have consolidated total assets of over Rs. 4,84,000 crores (over US $ 105 billion), which is diversified across a wide range of asset classes across retail, wholesale and rural banking.

ICICI Bank is amongst the most profitable banks in India. In FY 08, ICICI Bank made a profit of Rs. 4,158 crores (US$ 900 million).

ICICI Bank has the highest credit ratings in the Indian financial sector. We have AAA ratings for our instruments, such as senior bonds, subordinated bonds, and deposits. We have the highest foreign currency bond ratings assigned to any Indian bank from Moodys and S&P.

We continue to invest in growth, indicating our confidence in the opportunities in the Indian market. In 07-08, ICICI Bank added 650 new branches, taking the total strength to over 1400 branches.

We thank you for reposing trust in us over the years. We look forward to setting new benchmarks in service levels in India and to create a bank that you will continue to be proud of.

As a testimony to the above ,please find below the clarification given by Reserve Bank of India:

Date : 30 Sep 2008

RBI Statement on ICICI Bank's Financial Position

There are reports in some sections of the media that based on rumours regarding the financial strength of ICICI Bank, depositors are withdrawing cash at its ATMs and branches in some locations.

It is clarified that the ICICI Bank has sufficient liquidity, including in its current account with the Reserve Bank of India, to meet the requirements of its depositors. The Reserve Bank of India is monitoring the developments and has arranged to provide adequate cash to ICICI Bank to meet the demands of its customers at its branches/ ATMs.

The ICICI Bank and its subsidiary banks abroad are well capitalised.

Alpana Killawala

Chief General Manager

Press Release : 2008-2009/412

Sincerely,

Rakesh Sah

Office of Head Service Quality

ICICI Bank Limited

Dear depositors,

ICICI is number one bank. Please withdraw your all money from SBI and HDFC and deposit into ICICI?

You will be in the safe hand.

Best regards,

ICICI Customer

Hi,

Please help me make a decision whether I should withdraw my funds from ICICI Bank.

I will be glad if you could mail me your views on my id vaifin@yahoo.com

Vaibhav

if Lehman Brothers,Merylinch like companies have colapsed how ICICI will able to withstand the Crisis so be aware of this and if possible please widrw your all money.

i am removing all my money, who wants to take risk, if we lose the hard money i will collapse. I dont know about others let them take chance. Precaution is better than cure. Thanks

Why icici bank risk in oct 2008?

--Due to huge exposure in overseas bank is risk now...

--more than 10 thousand crore withdrawl in last one month due to panic....is RISK now

--More credit card holders become bad debtors currently is risk now..

--Big financial giants like Lehman ,Morgan got screwed during this crisis....so ICICI is high risk now...

--Market capitalization reduced 60% approx...in last one year...is very high risk now...

--Above all...stock price of ICIC crashes...which is very big risk now.....by oct 2008...

So investors...pls b away from this ICICI stock...to safeguard your hard earned money...as Retail investor and customer....

By....WHO interest in public...

Even last time the rumours started in Gujarat and even this time its the same (some vernacular daily). These rumours are a load of bull!!! I am gonna invest in ICICI now since the stocks are a bargain now. There is no way its going under.....

ICICI Bank risk now:

Also bcz of...

FII pressure

Analysts said the large FII holding could be another reason for the drop in ICICI’s share price.

“The stock has been facing a lot of selling pressure due to concerns regarding its overseas exposures. It is just bad sentiment surrounding the stock which has made the share price go below fundamental levels,” “Though the share price has come down to very attractive levels due to the risk perception surrounding the company, it was still sold heavily.”

A total of 4.73 crore shares of ICICI were traded on NSE and the BSE on Friday

--Also due to panic...most of icici DMAT customers...transferred the shares to other safety banks...in huge nos

--But here...one thing to notedown..is most of financial giant top level executives and bosses getting their bonus,incentives and salaries in millions and billions of dollars, but finally getting screwed is RETAIL INVESTORS

even after reversing an account for final one time settlement ICICI does not close the account immediately. The bank keeps the account open to show higher receivable there by enhancing its current profit and net asset value.We do not know if RBI is aware of this tactics.

http://enewss.wordpress.com/2008/10/10/icici-banks-risk-rises/

Even if ICICI bank is safe, its earning potential and growth is vastly minimized because of several reasons.

a) Most of their earnings will go towards insuring their bonds.

b) Most of their earnings will eavaporate due to losses in CDOs.

I have already said that ICICI bank stock is at risk and its share price will drop below RS 300.

I will not buy ICICI stock, unless the CEO, CFO and other executives buy their own stock in open market.

------------------------

http://www.moneycontrol.com/india/news/business/first-cdo-sold-by-icici-bank-overseas-mkt/17/59/305260

The recent turmoil in global markets forced retail investors to come to terms with esoteric debt market instruments like collateralised debt obligations or CDO and credit default swaps or CDS.

India's holiest river the Ganga is making ripples in financial circles. Two financial giants ICICI and Barclays Capital Asia have designed a derivative product - the Ganges Transaction to reduce their risks.

The Ganges Transaction in banking jargon is a collateralised debt obligation or a CDO.

It is a pool of bonds or loans that are packed together and sold by banks so as to reduce credit risk from their books.

The Ganges transaction comprised USD 300 million of credit default swaps written by ICICI and Barclays.

A credit default swap is bought by an investor in an FCCB or an ECB to protect oneself from default risk by the company taking the loan. The FCCB holder pays to the seller of the credit default swap a periodic interest rate, which is a spread over LIBOR.

In the Ganges transaction ICICI and Barclays pooled together 60 such credit default swaps - and then put into an independent Trust, this trust then divides the pool into 3 tranches - triple A rated paper which is senior debt, then comes the mezzanine debt which has a triple B rating and then finally the unrated paper which is the most risky. Once the debt is divided, the Trust issues pass through certificates to targeted investors.

"We used synthetic derivative technology to repackage the credit risk of those names into various rated and unrated tranches and because various tranches get various spreads and these are sold to targeted investors with various risk appetites. This results in transfer of risk into the pockets of these investors" says How Chih Lee, Barclays Capital Asia.

The investors in these debts are usually other banks, corporates and more commonly hedge funds. One would ask why would investors want to buy such instruments?

Because these complex high-risk structures also mean higher returns. According to bankers unrated paper fetches them upto 15 to 20% returns and senior debt helps them earn about 5%.

While Indian banks can write credit swaps on foreign loans taken by Indian companies, they can do so for rupee loans. But that may change soon.. The Reserve Bank is drawing up guidelines to facilitate such products in India soon.

Post a Comment