Election Time Stock Returns

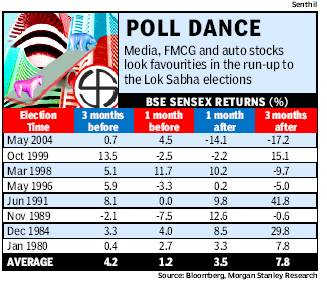

Election Time Stock ReturnsIt appears that the stock market show a strong correlation with the national events like the elections. If we go by the past data for stock market price movements from 1980 onwards, there seems to be on an average, 4% gain in 3 months before the elections of Lok Sabha in India.

This average value s at 4% because it was in 2004 when there was a very small return of 0.7% in 2004 and a -2.1% in 1989 elections. On all the other occasions, the 3 months return from the stock markets before the elections has been much higher, as much as 13.5%.

Though the gains in 2004 and 1980 were less than 1% returns in the three-month period before the polls, they were still positive.

The only time it went into negative territory was in 1989 due to the Bofors controversy.

What is the reason for good positive returns from the stock market during the election times?

As per EconomicTimes, From the investors’ point of view, sectors such as media, FMCG and auto look favourities in the run-up to the elections as polls are known to boost consumption. "Readership of newspapers goes up during elections and so does news channels’ viewership. Also, though it is not legally allowed, Sales & profits of alcoholic beverages shoot up during elections; and with increase in money supply, more pronounced in rural areas, personal care products are also likely to benefit. Auto sales usually go up (marginal increase) as SUVs are used for election campaigns, personal transportation and security of politicians.

Even this year, since March 16 - exactly one month to the elections - the index has already risen by 2.5%. But will the market sustain the momentum postelection? Analysis since 1980 shows that a month after the polls, the bellwether index posts an average rise of 3.5%. On six out of the eight times since 1980, investors have made gains.

So is it the time to take the bet? Well, it all works randomly, so take your own shots and hope for the best!

No comments:

Post a Comment